What do schools feel about their MIS?

We know that the functionality of a school’s management information system (MIS) is central to how easily it can extract, analyse and act on data about its pupils, and therefore move the school forward. With the MIS very much “the engine room” of a school, we wanted to understand:

How well school leaders felt their MIS was delivering results

What’s important to schools in an MIS

Whether schools have any plans to switch MIS provider in the next 12 months

For the second year in a row, we surveyed schools to find out what they felt about their current MIS - this year putting our questions to them in July 2022. We had 1,482 completed responses in total to the survey (N.B. a sample breakdown can be found at the end of this blog).

We collected a minimum of 100 responses from the customers of each of the 5 main MIS brands by market share (Arbor, Bromcom, RM Integris, ScholarPack and SIMS), to ensure a robust sample. Due to the smaller number of schools purchasing alternative brands, we weren’t able to achieve a large enough sample size of these customers to ensure robustness - so we’ve not drilled down beyond the 5 providers listed above.

It's important to note that The Key, which conducted this survey, is part of The Key Group, along with 2 MIS products: Arbor and ScholarPack. We have endeavoured to run and report on this survey without bias, to reflect back the MIS experiences of peers as an aid for those leading on MIS decisions for their school. And so, we offer the full results for each question below, without additional commentary or interpretation. For more information on the survey methodology and how we've handled the data, please see the ‘a note on the sample’ section at the end of this blog.

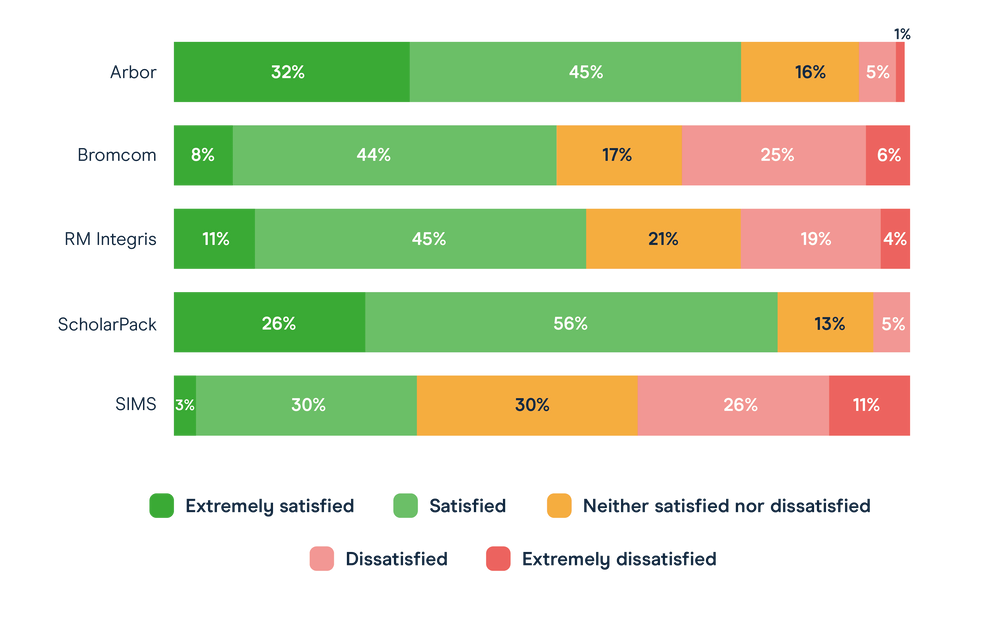

How satisfied are schools generally with their MIS?

Satisfaction rates vary. When asked to rate their satisfaction with their MIS on a scale of 1 to 10, the picture for the schools in our sample looks as follows.

Graph 1 - “How satisfied are you with your MIS? Please select a score from 1 to 10, where 1 is "Extremely dissatisfied" and 10 is "Extremely satisfied"”, base = 1,482 respondents

Next, we looked to see how satisfaction rates differ by MIS brand. The following graph displays satisfaction rates with their current MIS provider for our school respondents (for those with the top 5 MIS brands by market share).

Graph 2 - “How satisfied are you with your MIS? Please select a score from 1-10, where 1 is “Extremely dissatisfied” and 10 is “Extremely satisfied””, base - 1,404 respondents

On looking at the respondents rating their MIS as either a 9 or 10 in terms of satisfaction (10 being “extremely satisfied”), we see that 43% of ScholarPack customers have selected either of these top 2 scores. For Arbor, it’s lower at 35% of customers choosing these top 2 scores, and for RM Integris, it’s 27% of customers. These compare to 16% of SIMS customers and 15% of Bromcom customers in our sample choosing these scores.

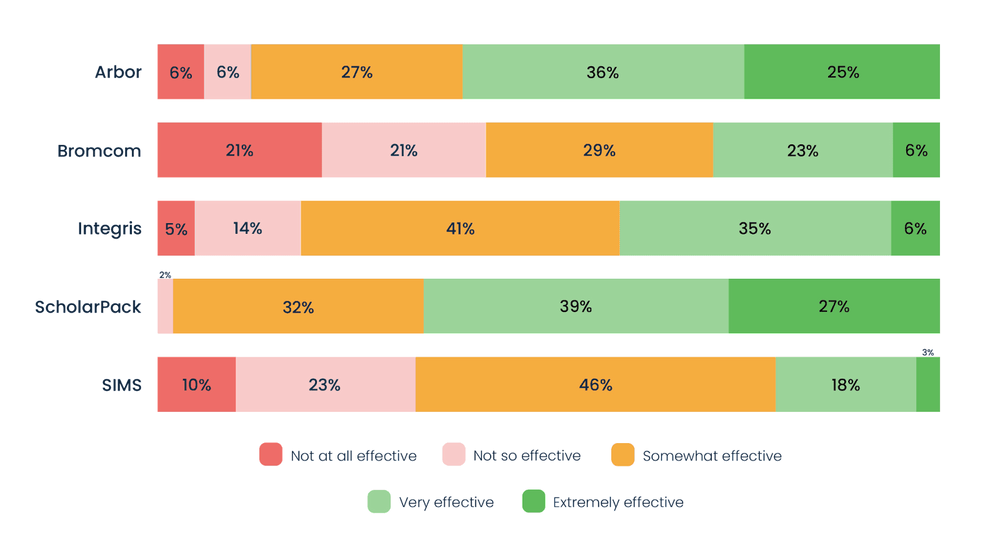

How satisfied are schools with the various aspects of their MIS?

MIS products are increasingly complex systems, and need to meet multiple needs for different audiences. This might include supporting the attendance officer with attendance data, helping leaders to make decisions on where intervention support is best targeted, or triangulating data on behaviour, safeguarding and seating plans to ensure pupils are physically in a safe environment. So, broken down, how do these 5 brands fare for their users?

Intuitiveness for new users

When a new staff member joins the school - whether that be in an office-based role, as a class teacher or as a member of the senior leadership team - how easy is it for them to get to grips with the MIS, if they’ve not used it elsewhere previously?

Graph 3 - “How satisfied are you with how intuitive the MIS is for new users?”, base = 1,404 respondents

Arbor had the highest percentage of its customers (32%) reporting that they’re “extremely satisfied” with how intuitive it is for new users. This compares with 3% of SIMS customers in our sample reporting as “extremely satisfied” on this point.

Integration with other systems and software

The MIS needs to integrate with many other systems - whether that’s to facilitate assessment, payments, communications or school improvement. How satisfied are each brand’s customers with how well their MIS does this?

Graph 4 - “How satisfied are you with the extent to which the MIS integrates with other systems / software?”, base = 1,404 respondents

Satisfaction levels on integration were highest for customers with ScholarPack (28% of ScholarPack customers in our sample voted “extremely satisfied”) and Arbor (20% of Arbor customers voted “extremely satisfied”). Overall satisfaction (a combination of “extremely satisfied” and “satisfied” customers) was also strongest among these 2 brands (78% for ScholarPack; 69% for Arbor).

The most dissatisfied customers in our sample (combining “extremely dissatisfied” and “dissatisfied” ratings) on this integration point are those with Bromcom (19% of Bromcom customers in our sample).

Functionality

We know (see the final section of this blog) that “functionality” is the single most important factor when schools are looking for a new MIS supplier. So, how do schools rate their current MIS on this?

Graph 5 - “How satisfied are you with the functionality of the MIS?”, base = 1,404 respondents

Arbor had the highest percentage of its customers in our sample saying they are “extremely satisfied” (30%) with its functionality. ScholarPack just surpassed Arbor on overall satisfaction (“extremely satisfied” and “satisfied” combined) for functionality, with 82% of the ScholarPack customers in our sample rating themselves as “satisfied” or above (compared with 77% of Arbor customers).

Dissatisfaction on functionality (a combination of “extremely dissatisfied” and “dissatisfied”) appeared to be felt most keenly among the customers of Bromcom and SIMS in our sample (20% of each of these brand’s customers voted in this way).

The quality of support received

MIS providers generally give support to their customers either directly, or via third party agencies - some of which are part of local authority teams, and some of which are independent. We didn’t ask schools to differentiate, but were interested in how, generally, they perceive the quality of support available to them with their MIS?

Graph 6 - “How satisfied are you with the quality of support you receive?”, base = 1,404 respondents

The highest-scoring provider here for the quality of its support, in terms of overall satisfaction (“extremely satisfied” and “satisfied” combined), was ScholarPack, with 79% of its customers in our sample voting in this way. This was followed by RM Integris, with 71% of its customers reporting as “satisfied” or above with the quality of support. 65% of Arbor customers also voted in this way, along with 58% of SIMs customers and 51% of Bromcom customers.

Provision of actionable information

Increasingly, leaders, teachers and administrators expect their MIS to provide them with data that they can act upon. Whether that’s to make decisions around resourcing, involving parents or outside agencies, or simply informing meaningful conversations between staff. How well do schools feel their MIS supports them in taking action?

Graph 7 - “How satisfied are you with the extent to which the MIS provides actionable information?”, base = 1,404 respondents

ScholarPack customers in our sample were most likely to say they are “extremely satisfied” with its provision of actionable information (30%), with overall satisfaction (“extremely satisfied” and “satisfied” ratings combined) also strongest amongst its customers (82%). 72% of Arbor’s customers in our sample felt similarly satisfied overall with their ability to take action. This decreases to 62% of RM Integris’s customers, and 54% of Bromcom’s customers. Less than half of SIMS customers in our sample said they felt “satisfied” or above with their MIS in this area (43%).

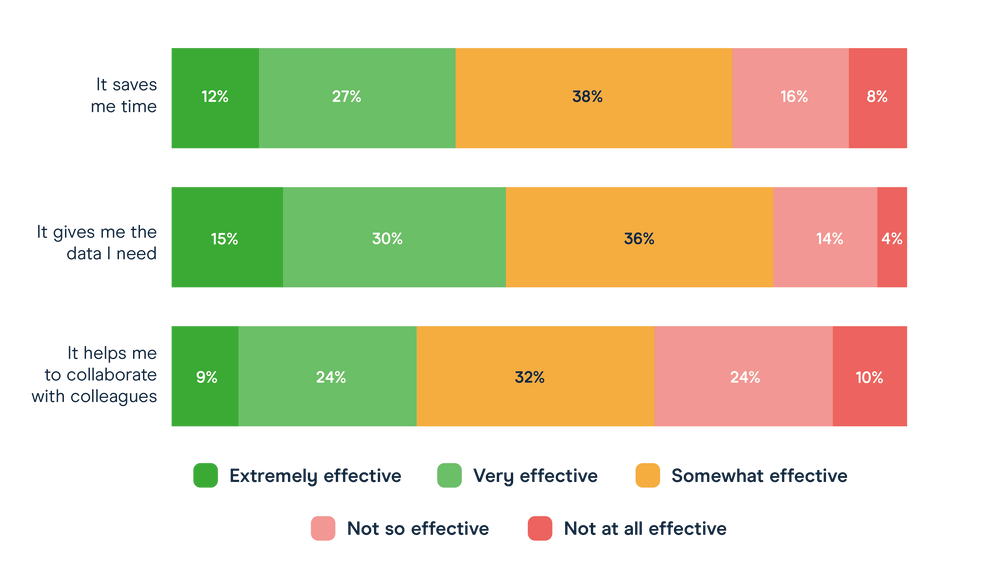

How effective is their MIS at providing a range of benefits?

Thinking about some of the core benefits associated with using an MIS, we asked schools to tell us how well theirs stacked up. We reasoned that 3 core benefits from an MIS would likely be: saving time, extracting data to perform tasks and supporting collaboration between colleagues.

Looking at the responses from all respondents, we can see that nearly a quarter (24%) of schools didn’t feel their MIS is effective at saving them time, nearly 2 in 10 (18%) didn’t feel it’s effective at giving them the data they need to do their job well, and over a third (34%) didn’t believe their MIS is effective at helping them to collaborate with colleagues.

Graph 8 - “How effective is your MIS at providing you with the following benefits?”, base = 1,482 respondents

Saving time

Breaking out the data by these main 5 brands by market share, the following graph shows us how effective their customers thought their MIS was at saving them time.

Graph 9 - “How effective is your MIS at saving you time?”, base = 1,404 respondents

When it comes to saving time, 71% of ScholarPack’s customers in our sample voted that it’s “very effective” or “extremely effective” at saving them time. This was followed by Arbor, with 57% of its customers voting in this way, RM Integris with 40%, Bromcom with 33% and SIMS with 28%.

Providing the data needed to do the required jobs well

An MIS, at its core, needs to provide data to a range of people working in schools and trusts, which in turn helps them to perform their jobs well. This may be a data manager or office administrator who’s immersed in the MIS for the best part of their day, or a teacher needing quick access to parental contact details. How well do schools think their MIS performs in this regard?

Graph 10 - “How effective is your MIS at giving you the data to do your job well?”, base = 1,404 respondents

ScholarPack has the most votes on overall effectiveness (a combination of “very effective” and “extremely effective” ratings), from 69% of its customers in our sample, for providing the data to do their job well. This is followed by Arbor with 59% of its customers voting in this way, RM Integris with 47%, and Bromcom and SIMS both with 38%.

Helping collaboration with colleagues

Those running schools will rarely be acting in isolation. How does the MIS enable colleagues to collaborate around issues, events, information and opportunities?

Graph 11 - “How effective is your MIS at helping you to collaborate with colleagues?”, base = 1,404

Generally, respondents were less in agreement about effectiveness of their MIS when it comes to collaboration, compared with responses on saving time and getting data to do their jobs well.

Overall effectiveness (“very effective” and “extremely effective” combined) had the most votes from ScholarPack customers, with 56% of its customers in our sample agreeing with this rating. Following this, just under half (48%) of Arbor customers in our sample felt their MIS was “very effective” or above at supporting collaboration. 34% of RM Integris customers in our sample agreed with this effectiveness rating, closely followed by 31% of Bromcom customers. A quarter (24%) of SIMS customers in our sample felt their MIS was “very effective” or above at helping them to collaborate.

Will schools be changing their MIS provider in the next 12 months?

We were interested to look at what percentage of schools were planning on switching to an alternative MIS in the next 12 months - another proxy to see how satisfied they were with their current provider.

When we asked this question in April 2021, 14% of respondents said they were “very likely”(8%) or “likely” (6%) to switch in the next 12 months, compared with 65% who were not (24% were “unlikely”, and 41% were “very unlikely”, to move).

However, there’s been significant movement in the last 12 months, with many more schools having switched providers than in previous years, according to data from the most recent census in May 2022 (and commented on in detail in this Bring More Data* blog post).

Just over a year later (July 2022), we’ve now asked the same question about changing MIS provider in the next 12 months - recognising that the many schools that had made the switch in the previous period, were unlikely to be interested in switching again in this period.

Breaking this out by the 5 brands we’ve outlined above, answers from the customers in our sample looked as follows.

Graph 12 - “How likely are you to consider changing your MIS provider in the next 12 months?”, base = 1,404 respondents

Overall this year, 16% of total respondents are considering switching (9% responded with “very likely”, 7% with “likely”), which is up only 2 percentage points from last year. Those not considering switching are at broadly the same level as last year (at 66% of respondents - up by 1 percentage point from last year).

If we look at where those likely to switch this year are coming from, we can see that 22% of those currently using SIMS in our sample are “likely” or “very likely” to move, and 19% of RM Integris customers in our sample are, too. Interestingly, given how well ScholarPack has performed in a number of other questions, 8% of its customers are also “likely” or “very likely” to switch MIS in the next 12 months. The remaining 2 brands can expect very little churn, based on this data (only 1% of Arbor customers and 5% of Bromcom’s customers said they are “likely” or “very likely” to switch).

What is the most important factor for a new MIS?

Finally, we wanted to understand what the most important factor would be if schools are looking for a new MIS supplier. As previously mentioned, “functionality” by far and away tops this list, with 61% of respondents putting this as their top priority.

Graph 13 - “What is the most important factor when looking for a new MIS supplier?”, base = 1,482 respondents

A note on the sample

The Key sent this survey to all primary, secondary and special schools, as well as pupil referral units, in England, via email. The survey ran from 5 to 19 July 2022, and asked the same questions as a previous survey run by The Key in April 2021.

It was completed by 1,482 respondents. We met self-imposed quotas of at least 100 responses from the main 5 MIS brands by market share (Arbor, Bromcom, RM Integris, ScholarPack and SIMS). The breakdown of responses from these providers was:

Arbor: 202 respondents

Bromcom: 186 respondents

RM Integris: 176 respondents

ScholarPack: 149 respondents

SIMS: 691 respondents

In addition, we gathered data from schools using Advanced Learning, IRIS Ed:gen, iSAMS, Juniper Horizons, Pupil Asset, and SchoolPod - although these sample sizes were too small to break down.

The data has not been weighted by provider, nor has it attempted to be representative by phase, role, type of school or region.

* Please note that any views expressed in the Bring More Data blog linked here, as well as any recommendations on commercial providers, products and resources in this same blog, are the writer's own and should not be considered an endorsement by The Key.